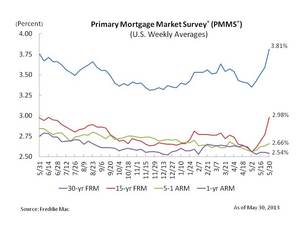

Fixed-rate mortgages soared higher this week, reaching their highest averages in a year, Freddie Mac reports in its weekly mortgage market survey.

The 30-year fixed-rate mortgage -- the most popular choice among home buyers -- has climbed nearly half a percentage point since the beginning of this month -- from 3.35 percent to 3.81 percent this week.

"Fixed mortgage rates followed long-term government bond yields higher, following a growing market sentiment that the Federal Reserve may lessen its accommodative policy stance,” says Frank Nothaft, Freddie Mac’s chief economist. “Improving economic data may have encouraged those views.”

Despite the uptick, mortgage rates remain low by historical standards, Freddie Mac reports.

The mortgage giant reports the following national averages with mortgage rates for the week ending May 30:

- 30-year fixed-rate mortgages: averaged 3.81 percent, with an average 0.8 point, rising from last week’s 3.59 percent average. A year ago at this time, 30-year rates averaged 3.75 percent.

- 15-year fixed-rate mortgages: averaged 2.98 percent, with an average 0.7 point, rising from last week’s 2.77 percent average. Last year at this time, 15-year rates averaged 2.97 percent.

- 5-year adjustable-rate mortgages: averaged 2.66 percent, with an average 0.5 point, also up from last week’s average of 2.63 percent. Last year at this time, 5-year ARMs averaged 2.84 percent.

- 1-year ARMs: averaged 2.54 percent, with an average 0.5 point, dropping from last week’s 2.55 percent average. A year ago, 1-year ARMs averaged 2.75 percent.

Source: Freddie Mac